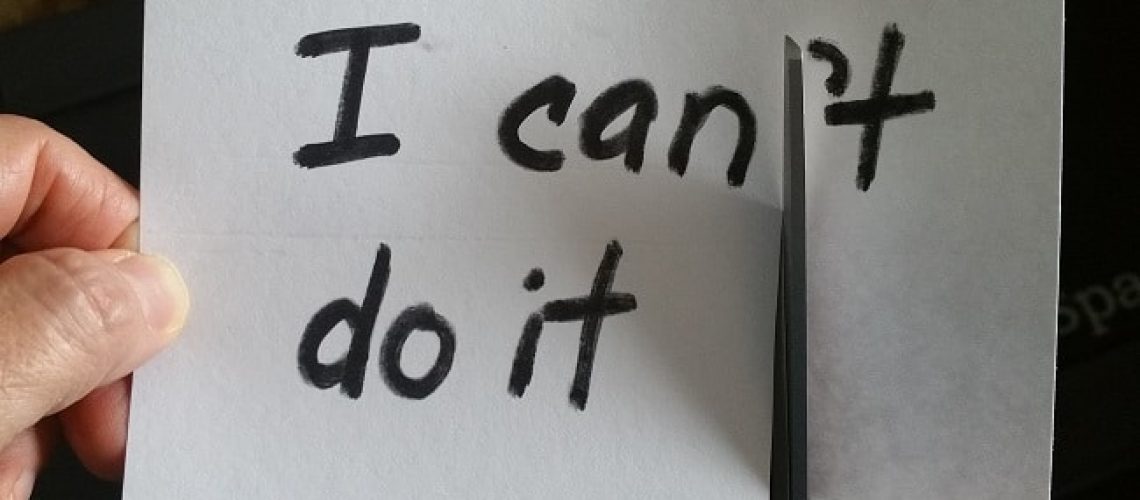

My daughter took me to task this week when she saw my proposed title for this blog post on a scrap of paper.

“What’s this?” she asked. “You’re always telling me to to act with more confidence, and now you’re going to tell women that it’s OK not be confident?” she asked, incredulous.

“Not quite,” I replied.

It’s perfectly true that I view a lack of confidence as a big problem for both girls and women. It affects how we think about ourselves, it influences how much we ask to be paid for our skills and services, and it ultimately has an impact on our results, which is why I have spent years encouraging women to believe in themselves and act accordingly.

You can imagine my surprise, then, when I discovered that there is one area in which women’s uncertainty actually pays off: investing. Let me explain.

A few years ago, I came across a book that would prove to be a game-changer for me. It was Mariko Lin Chang’s Shortchanged: Why Women Have Less Wealth and What Can Be Done About It. In this brilliant, scholarly tome, I discovered the concept of the wealth gap. Sure, we all know that women, on average, earn less than men, but more importantly, women have a lot less wealth than men. There is a roughly 20% income gap, but a staggering 65% wealth gap. In short, women aren’t just earning less than men, they are saving and growing their wealth at a significantly lower rate. That’s a huge problem, since wealth creates options for us when life happens.

Notice I said when life happens, not if life happens. Life happens to everyone, at some point, and a larger net worth gives us options at those critical moments.

Chang went on to look at what was behind the disproportionately large wealth gap. She made some interesting findings:

- Men and women have a different perception of risk. This isn’t terribly surprising. We know that women, on average, tend to be more conservative than men. Chang goes on to discuss why that might be, but for now let’s focus simply on the difference.

- Women are more likely to view lost money as irreplaceable. This is what I call a poverty mentality: if we lose money through our investments, we see it as gone forever. Guys, on the other hand, figure they’ll make it back. They’re not happy about the loss, but it’s not the end of the world.

- Men have a greater sense of confidence about their ability to make money. Again, women focus on the loss, men focus on the potential gain.

- Research shows that women often perform better when making investment decisions. And here is the crux of my argument! More below.

- Despite the results, women still shy away from getting involved in investments.

One financial adviser with whom I spoke told me something along these lines: “The man in a couple goes on about what he’s read in financial magazines, the price of oil, the latest hot stock tip, and wants to discuss what they should be buying and selling. He wants action. The woman asks a lot of questions, assumes she knows little and has a slow, steady, cautious approach. She’s not looking for action, she’s looking for stability and protection. Hers is the more sensible approach. My advice to men is this: listen to your wife.”

I’ve read and heard the same thing from multiple, credible sources: men tend to be more confident about their ability to invest and therefore, they make more mistakes; women typically lack confidence and, as a result, they ask more questions, do fewer trades and have a more successful outcome when they get down to it.

Carl Richards, author of The Behavior Gap, Simple Ways to Stop Doing Dumb Things with Money, says it brilliantly: “Overconfidence is a very serious problem. If you don’t think it affects you, that’s probably because you’re overconfident.” In his book, which I highly recommend, he has a number of hilarious graphs, drawn with a Sharpie on napkins. One of my favourites depicts the cost of your mistakes on the Y axis and the level of overconfidence on the X axis. His point: the more overconfident you are, the higher the cost of your mistakes.

In his book Playing the Winner’s Game: Think, Act, and Invest Like Warren Buffet, Larry Swedroe mentions a study published in the Journal of Business in which men and women’s investing results were compared. “Men produced similar gross returns to women. However men earned lower net returns as their greater turnover negatively impacted results.” Single women apparently produced better net results than their married counterparts. Swedroe suggests that this is presumably because they were not influenced by their overconfident spouses!

So ladies, for once we can benefit from our overall lack of confidence. But here’s the rub: We won’t benefit unless we actually get down to the business of investing. As Chang notes, women tend to shy away from getting involved with investments even though they tend to outperform men when they do. If you’re so afraid of investing that you don’t ever do it, you will never build wealth. You can’t let fear harm your financial future.

It’s time to use our cautious natures to our advantage and start to grow the money we make. In my book, Protect Your Purse, I talk about the need to develop a strong net worth. We cannot save our way to wealth. Tony Robbins, in his book Money: Master the Game demonstrates that we cannot earn our way to wealth, either. We have to grow our way to wealth. Investing, therefore, is an integral part of the solution to closing up the massive wealth gap.

Once you’ve started investing, read this article by Ellen Roseman, to learn more about the concept of risk and how it can be used to your advantage.

If you’re thinking of letting a financial planner do the work for you, read this book: The Smartest Investment Book You’ll Ever Read by Daniel R. Solin. It’s a quick read and provides honest, blunt advice about what to avoid when it comes to finance advisers and the whole investment industry. You can also follow me through the process. I currently spend my days dissecting the financial advice and investing industry. I’m doing this digging in order to create a workshop to explain how the system works, cut out the baloney and give women straightforward information based on science and research. My goal is to provide women with three key ingredients: confidence (through education), a step-by-step plan (the what and the how), and a community of like-minded people who want results.

Let’s do this ladies. It’s time. And remember: use your lack of confidence to your advantage; don’t let it define you or stop you in your tracks.

2 Responses